Inattentiveness and the Investment Channel of Monetary Policy

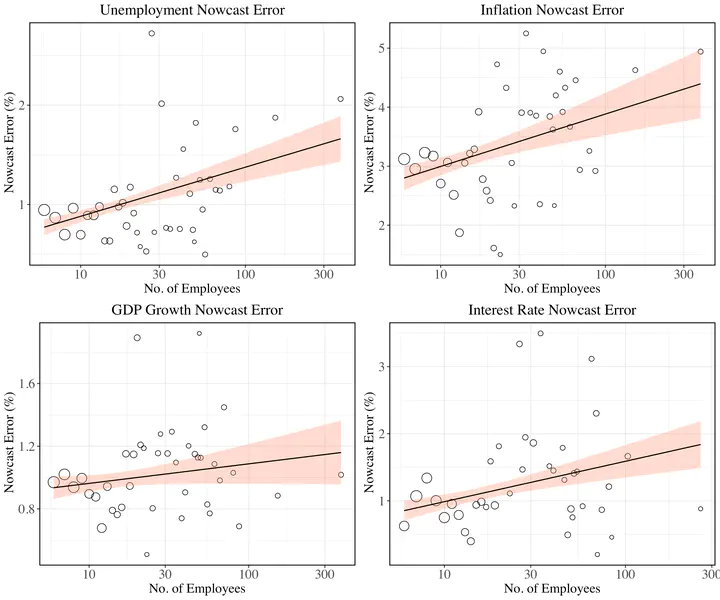

Firm size and nowcast error of aggregate variables

Firm size and nowcast error of aggregate variablesAbstract

How does rational inattention interact with financial frictions? I provide new empirical evidence from survey data that suggests that the answer to this question likely plays an important role in understanding macroeconomic dynamics. In a simple model, I show that financially constrained firms will generally choose to be more attentive to economic conditions, consistent with my empirical evidence. Embedding this mechanism into a DSGE model, I show that the aggregate response of investment to a monetary policy shock hinges on this interaction. The model also predicts that credit-constrained firms ultimately reduce their investment after an expansionary shock, a prediction that I confirm empirically.

Type