Monetary Policy and Corporate Default

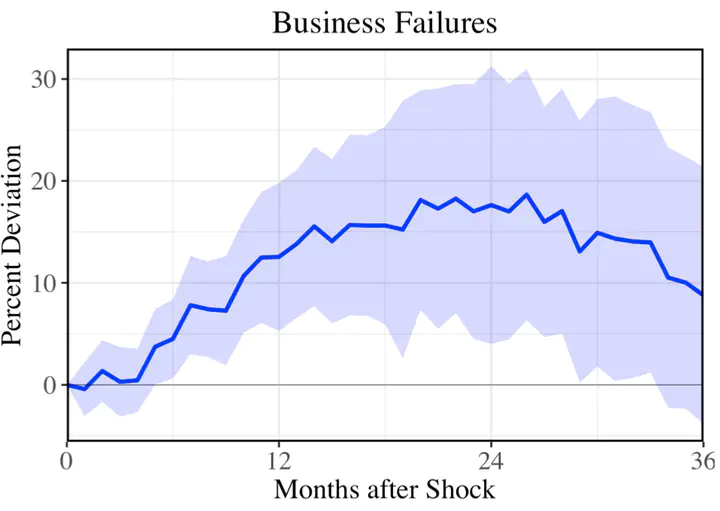

IRF of business failure to 1 percent contractionary monetary policy shock.

IRF of business failure to 1 percent contractionary monetary policy shock.Abstract

This paper shows that a contractionary monetary shock would increase the number of defaults and the aggregate liability of defaulted firms in the economy. The adverse effect of firms' default on the balance sheet of banks lowers the supply of credit and forces the interest rate of loans to rise. As a result, the cost of production grows even further, and more firms decide to file for bankruptcy. Using a DSGE framework, I show that Monetary policy can dampen this amplification mechanism by considering financial variables in the policy rule.

Type