Monetary Policy Shocks, Financial Frictions, and Investment

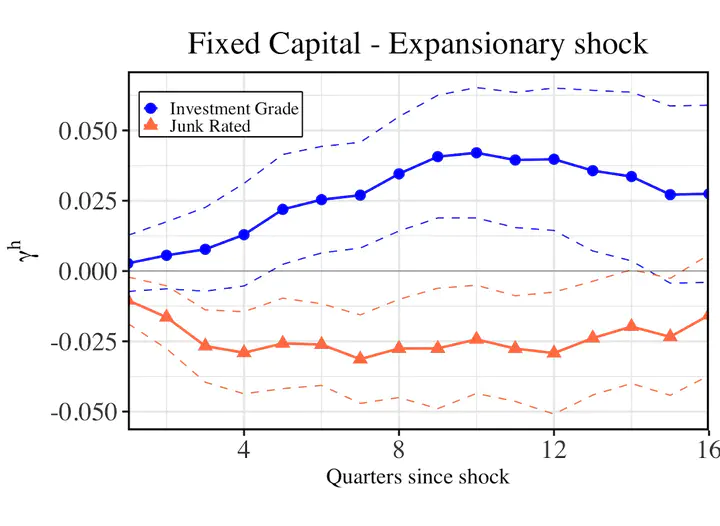

The effect of one s.d. expansionary monetary shock on fixed capital

The effect of one s.d. expansionary monetary shock on fixed capitalAbstract

Following an expansionary shock, high credit quality firms raise funds through equity and increase their fixed capital. Firms with low credit ratings, however, cannot raise equity or debt and reduce their fixed capital. I explain these results using a simple model with two types of firms. While unconstrained firms are free to finance their financial needs in the model, constrained firms face a trade-off between wage payments and investment. As wages increase after an expansionary shock, constrained firms have to cut their investment and, since they have less collateral, reduce debt.

Type